Corporate migration (redomiciliation) is the process by which a company moves its domicile - or place of incorporation - from one jurisdiction (country) to another by changing the country under whose laws it is registered or incorporated. It maintains the same legal identity. The ease with which corporate migration may take place has increased in recent years.

As much as a company can change its registered office or registered agent within the same jurisdiction, it can also move to a new jurisdiction. Redomiciliation enables companies to avoid liquidating the existing company and transfer portfolio of assets to an entity, incorporated for that purpose in a new jurisdiction.

Companies migrate for a variety of reasons, including:

-

To benefit from a favourable tax environment

-

Take advantage of less stringent regulation and scrutiny

-

Align their place of registration with their shareholder base

-

Move to an international financial centre

-

Access specialist capital markets

When an existing company migrates, the company’s existing legal status, goodwill and operational history is preserved. This process allows for companies which currently operate in more expensive, difficult regulatory, high tax and high risk environments in other countries to migrate to another country without triggering a disposal of their assets or a diminution in their goodwill or operating history.

Benefits of Migrating to the UAE

In line with the international practice of permitting companies to change their seat of incorporation, companies are allowed under the laws of the UAE to change their jurisdiction.

The registration system of authorities in the UAE allows companies to base their global operations and activities in the UAE, at very competitive costs. On the contrary, in many other countries offering such opportunities, the cost of similar services is far higher. Companies from offshore jurisdictions migrating in the UAE, can carry out business operations within the UAE, provided appropriate licences are obtained.

The UAE has successfully established itself as one of the premier structuring hub worldwide, primarily capitalizing on the following competitive advantages:

-

Zero tax regime

-

Wide range of corporate vehicles

-

Extensive network of tax treaties with over 80 countries

-

Full repatriation of capital and profit

-

Recognized financial hub

-

World-class infrastructure facilities and connectivity

-

Presence of internationally recognized financial, legal and tax services providers

-

Primary hub and platform to access international business

-

High quality of life

-

Political stability and liberal business environment

Jurisdictions allowing redomiciliation

Corporate migration is particularly popular with companies registered in jurisdictions without

substance which have outgrown their environment and now seek to capitalize on the UAE’s advantages and benefits.

Accordingly, an overseas company, if authorized by the laws of the jurisdiction in which it is incorporated, can apply for continuation as a company in the UAE. Below, is a list of countries allowing redomiciliation:

Requirements

The outgoing jurisdiction

-

The outgoing company must be fully up to date with statutory filings

-

There must be no on-going legal proceedings against the outgoing company

-

Various documents need to be filed with and obtained from the outgoing registry

-

A certificate of good standing and certificate of incumbency must be obtained in every case

The incoming jurisdiction

Accordingly an overseas company, if authorized by the laws of the jurisdiction in which it is incorporated, can apply for continuation as a company in the UAE. The application must include all information and documents required by the UAE including resolutions, certifications, declarations, confirmations, opinions, authorizations and clearances.

The company must, within 3 months from the date of issue of the provisional certificate, file with the authority a certificate evidencing that the overseas company has ceased to be incorporated under the laws of the current jurisdiction and return the provisional certificate of continuation.

Upon continuation of a company in RAK ICC:

-

All assets, tangible and intangible, rights and all other property of any kind of the company continue to belong to the company

-

The company, its officers and directors continue to be liable for obligations of the company prior to its migration

-

Any existing cause of action, claim, duty or liability to prosecution in respect of the company is unaffected

-

Any civil, criminal or administrative action or proceeding pending by or against the company is unaffected

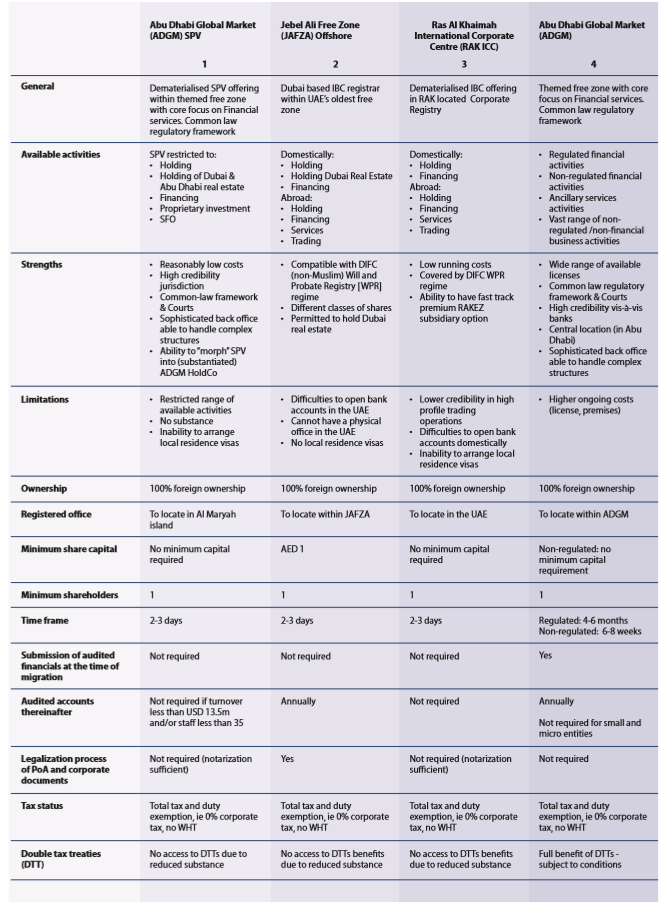

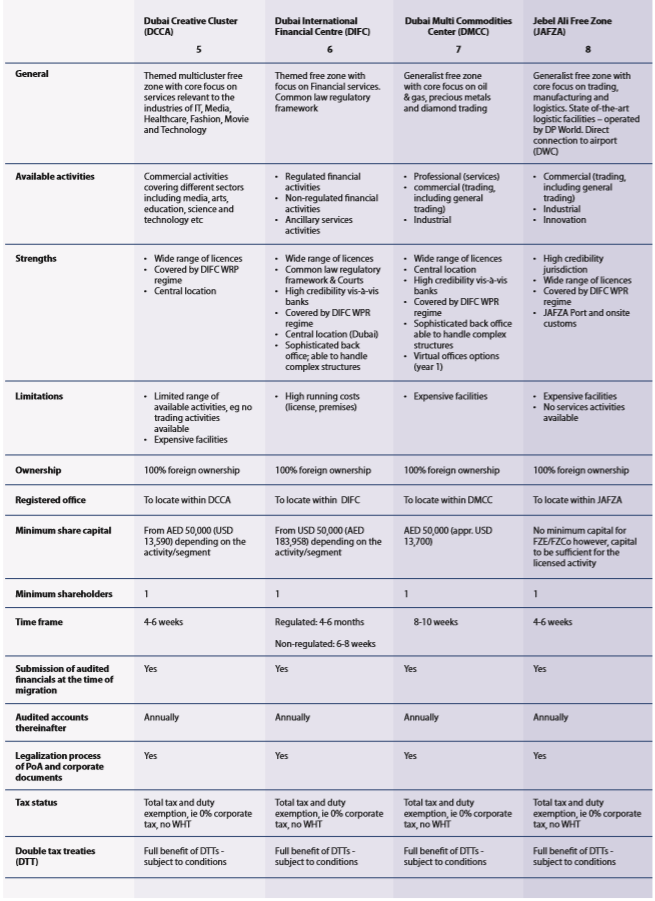

Which free zone support redomiciliation?

The list below sets out the Registries in the UAE which permit the corporate migration of foreign entities:

-

Abu Dhabi Global Market (ADGM) SPV

-

Jebel Ali Free Zone (JAFZA) Offshore Company

-

Ras Al Khaimah International Corporate Centre (RAK ICC)

-

Abu Dhabi Global Market (ADGM)

-

Dubai Creative Cluster Authority (DCCA)

-

Dubai International Financial Centre (DIFC)

-

Dubai Multi Commodities Center (DMCC)

-

Jebel Ali Free Zone (JAFZA)

Redomiciliation procedures each free zone:

Detailed process of Redomiciliation to RAK ICC

As an example, we now provide the details required by the RAK ICC.

Application for consent

A foreign company may submit through a registered agent to the Registrar of Companies in RAK to be registered in the UAE as a continuing company.

The application for consent must be accompanied by the following documents:

-

Statutory or regulatory provision which includes a reference to the statutory or regulatory provisions as amended or reenacted from time to time

-

Proof that the company has obtained all necessary authorizations and consents required under the laws of the jurisdiction in which it was incorporated

-

Certification that the company is, has been, and will remain as far as is reasonably foreseeable, solvent, signed by the directors of the company

-

Details of any charges created indicating the order in which they will be registered

-

The written consent of directors/shareholders to: (i) the making of the application and (ii) the order of registration of charges

-

A certificate signed by the registered agent making the application in the form prescribed in the regulations

-

The applicable fee

-

A notice in the form as depicted in the regulations announcing its intention to continue in the RAK FTZ

Registration

The registered agent, within 3 months from the time of consent must submit for registration the below:

-

The consent of the Registrar

-

Memorandum of Continuation or equivalent issued by the authorities in the jurisdiction in which the company is incorporated

-

Articles of the company which conform to the requirements of the regulations

-

Particulars in the form prescribed in the regulations, of any existing charge On delivery of the above documents the Registrar shall register the Memorandum of Continuation and:

-

Issue a certificate of registration of the Memorandum of Continuation

-

Enter in the Register of Charges under the international Companies Regulations, the particulars of charges delivered

-

The Memorandum of Continuation shall be deemed to be the Memorandum of Association

Quickest way to migrate?

If you are interested in migrating your corporation to the UAE, do not hesitate to

contact us.