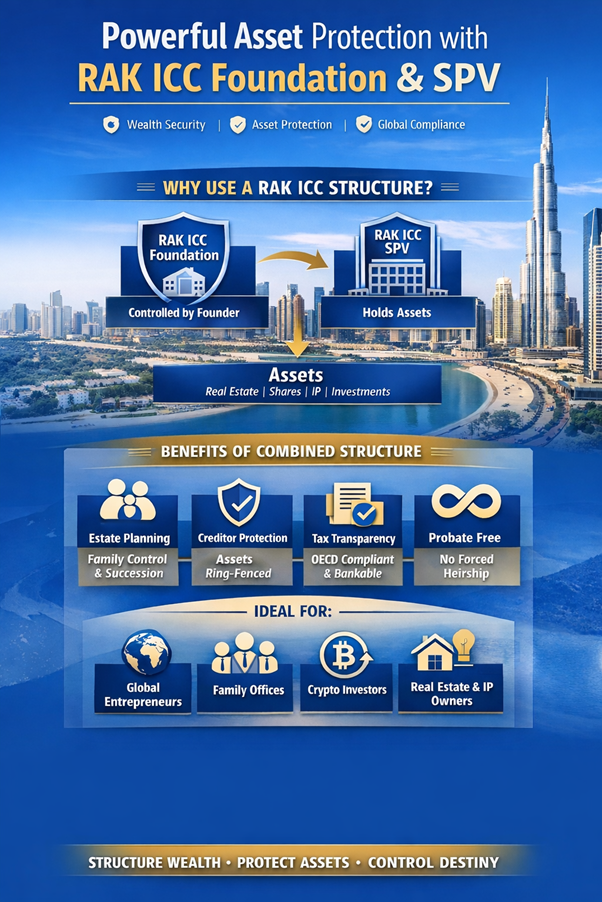

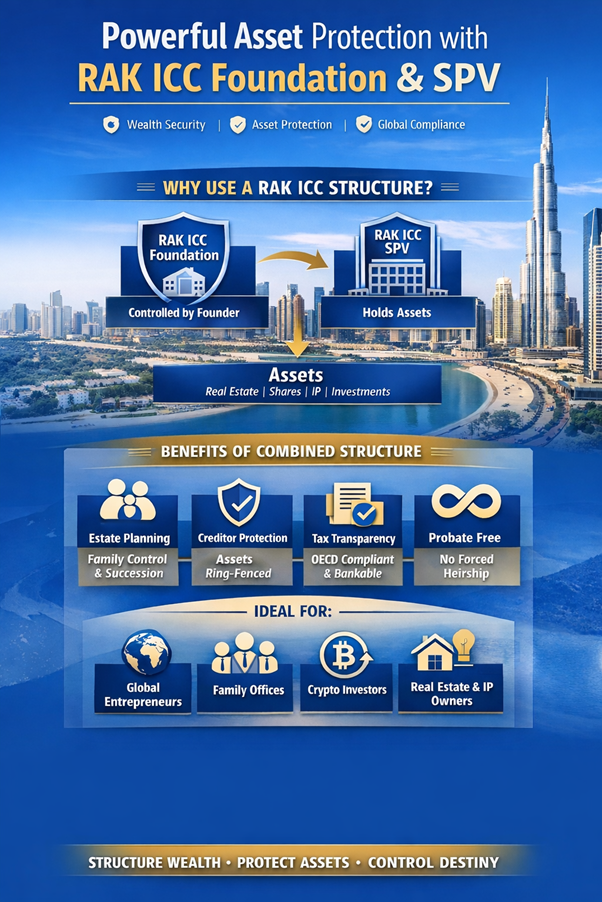

Why RAK ICC SPVs and Foundations!!!! Is the Smartest Way to Hold Global Assets?

Why RAK ICC SPVs and Foundations!!!! Is the Smartest Way to Hold Global Assets?

In today’s world of rising tax transparency, banking scrutiny, and cross-border inheritance risk, simply owning assets in your personal name or through a basic offshore company is no longer sufficient.

This is why sophisticated families and international entrepreneurs are increasingly using RAK ICC SPVs and RAK ICC Foundations as part of their global structuring strategy.

RAK ICC Foundation → owns → RAK ICC SPV → owns → Assets

The Foundation provides control and protection, while the SPV provides bankable and operational ownership of assets.

This combination delivers:

- Strong asset protection

- Succession planning without probate

- Reduced family and shareholder disputes

- Better acceptance by international banks

- Transparent and compliant ownership

Who Should Consider This Structure?

This model is particularly suited for:

- International entrepreneurs

- Family offices

- Real estate and IP owners

- Clients with assets in multiple countries

If your wealth is international, this structure gives you control without personal risk.

The future of wealth structuring is not about hiding assets; it is about holding them correctly.

RAK ICC Foundations and SPVs provide one of the most powerful and compliant frameworks available

today.

Contact us;

Freemont Oneworld Group – Dubai.

Email:

Info@freemontgroup.com